5

networks

PALESTINE EMERGING believes there is an opportunity to ‘leapfrog’ legacy solutions and establish a resilient network of utilities to serve local and regional interests.

ENERGY, WATER, DIGITAL

ENERGY

For decades, Gaza has faced critical shortages in energy supply. Prior to the recent conflict, Gaza’s power supply could only meet 45% of estimated demand, causing rolling power cuts, crippling economic activity, and undermining water treatment, sanitation, health and social services.

Energy and water issues are closely interrelated: without increased energy supply, desalination and improved wastewater treatment are not possible. Enhancing Gaza’s electrical grid and securing sustainable long term energy are essential to unlock Gaza’s broader economic recovery, not only to power normal economic activities but to secure reliable sources of potable water.

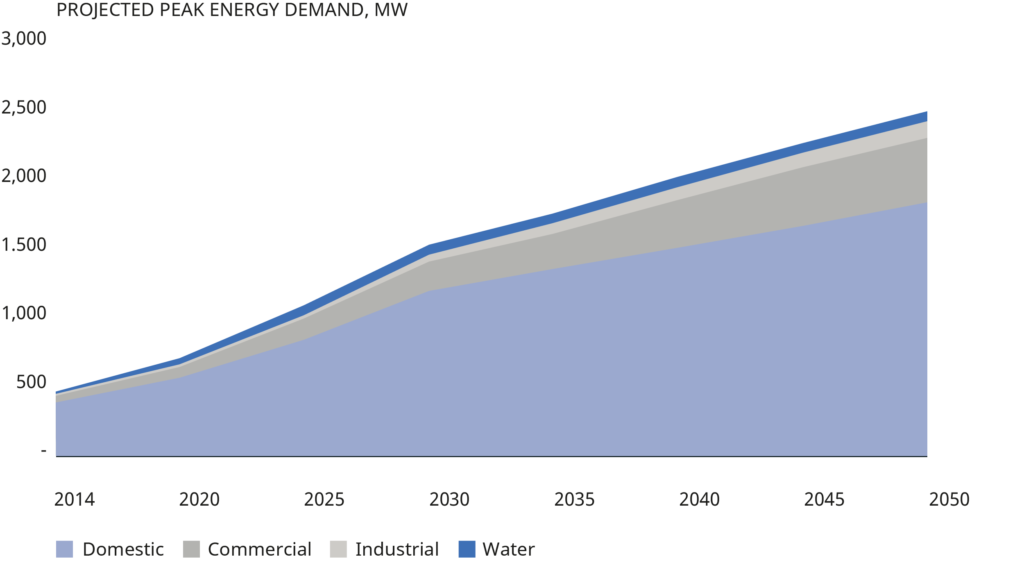

Our projections assume, by 2040, energy demand per capita (and the energy-intensity of commercial/industrial uses) will rise to a level similar to more developed regional economies, such as present-day Turkiye, and remain stable thereafter. Total peak demand – consisting mostly of domestic use – will be over 2,500 MW (Figure 15), a five-fold increase over the pre-October 2023 level of 470 MW. Water-related energy demand will also increase, but will represent a relatively small share of total energy consumption.

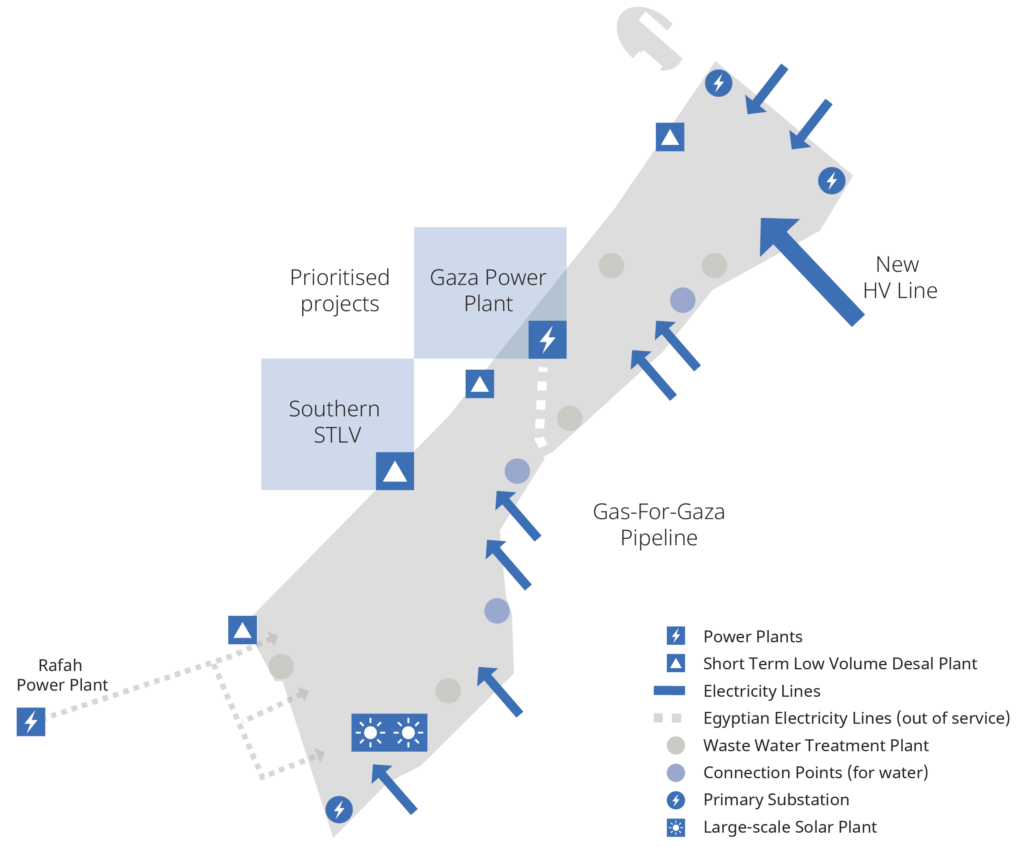

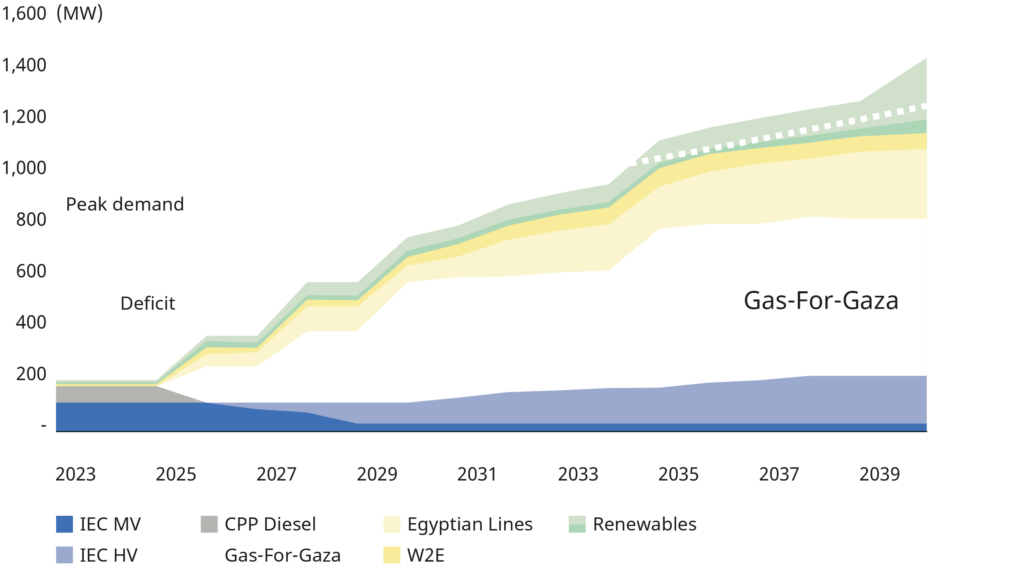

Beyond the provision of interim energy supply (including provisional links to Egyptian and Israeli networks), we anticipate the implementation of Gas for Gaza, Gaza Power Plant gas convergence, and increasing capacity for the Gaza Power Plant to 560 MW.

Longer-term, we anticipate the Palestinian entity will have an independent high-voltage grid, and integration with West Bank and regional utility networks. Gaza will develop a large-scale Solar Photovoltaic (PV) plant, exploiting extensive areas along its eastern boundary that can accommodate PV fields. Similarly, the West Bank will develop extensive solar farms in Area C.

Gaza and the West Bank will supplement central energy production with Package Solar PV plants, including innovative local solutions like Virtual Powerplants.

As Gaza restructures its economy, Palestine will exploit the offshore Gaza Marine natural gas field, exporting to Egypt for processing.

PROJECTED PEAK ENERGY DEMAND, MW

Fig 15 | QUARTET (2024a)

WHAT IS A VIRTUAL POWERPLANT?

Virtual Powerplants are distributed energy hubs in neighborhoods; they use rooftop solar on new housing and commercial premises, linked to community batteries.

Excess renewable energy is stored in the community batteries to provide energy during non-daylight hours. Each neighborhood energy node acts as an autonomous power network.

The neighbourhood energy nodes connect to the newly established Gaza grid system through an energy management platform, creating a Gaza-wide Virtual Power Plant (VPP). This will allow communities and businesses to sell unused renewable energy back to the grid for use elsewhere or export.

GAZA MARINE

Gaza Marine is a natural gas field located approximately 36 kilometers off the coast of the Gaza Strip. Developing the field represents one of the most significant projects for the long term sustainability of the Palestinian economy, offering decades of significant revenue opportunities.

Gaza Water Strategy – 2050

Gaza Waste Water Strategy – 2050

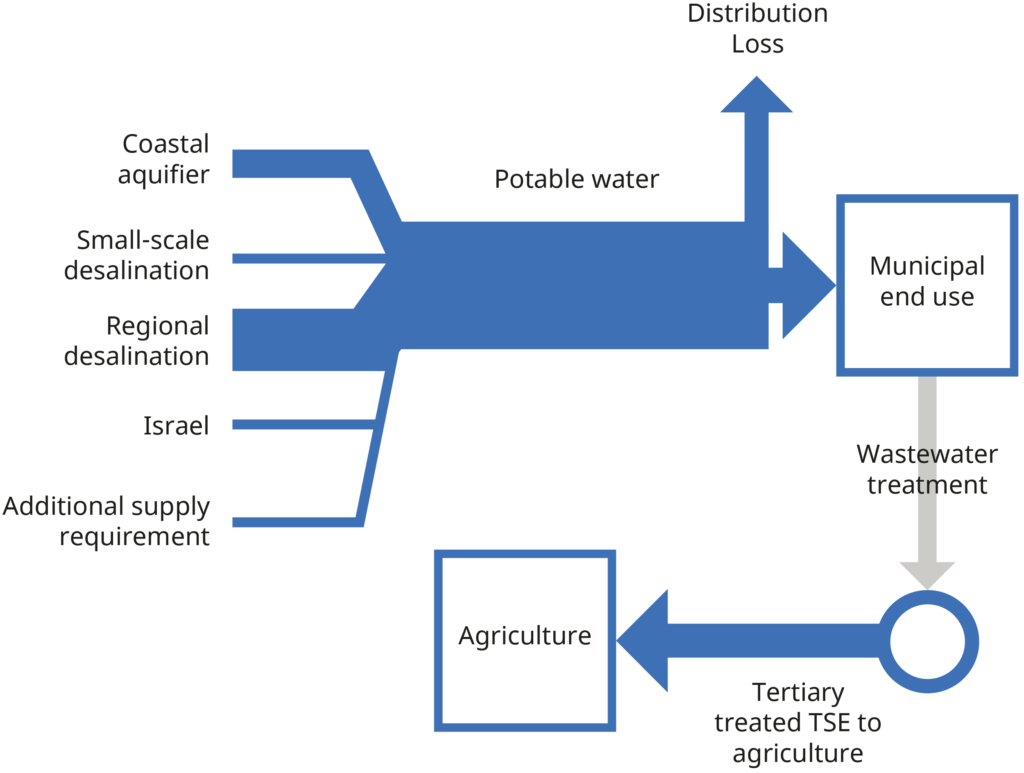

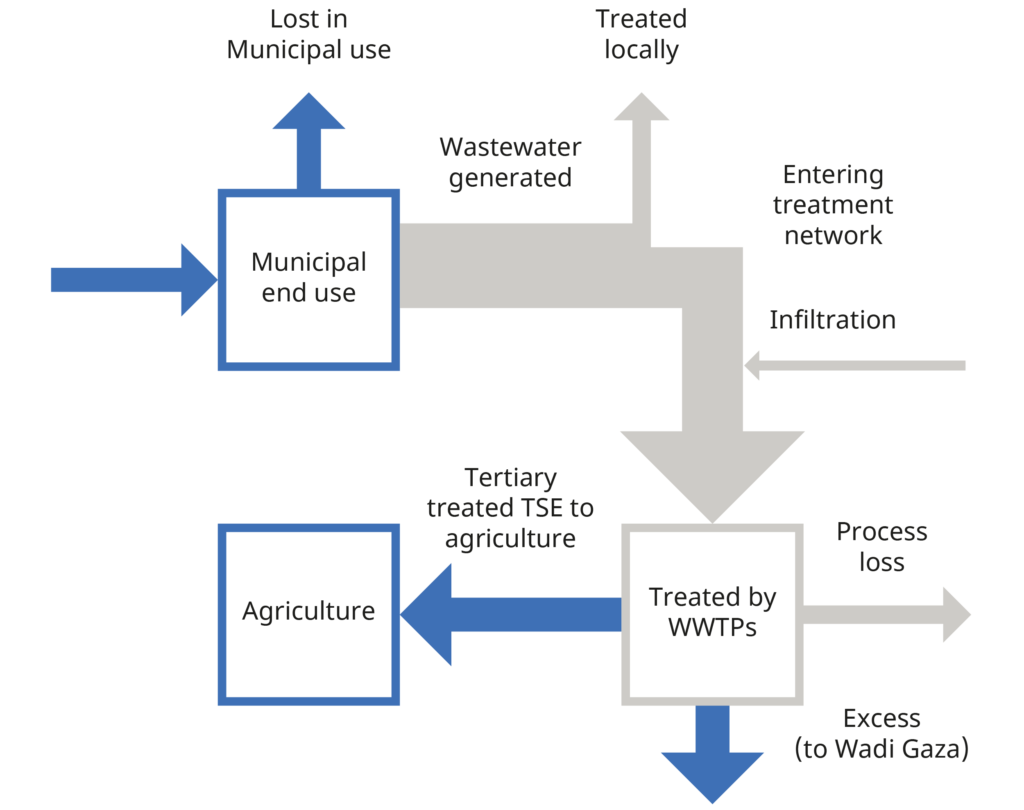

Figure 16 | PORTLAND TRUST AND THE PALESTINIAN PRIVATE SECTOR (2016)

WATER SUPPLY /

WASTE WATER TREATMENT

The rate of water abstraction from the Gaza aquifer is nearly four times the sustainable yield of 55 MCM/annum. The aquifer is highly polluted because of seawater intrusion and contamination from untreated wastewater, with only 4% considered suitable for human consumption. Wastewater collection and processing infrastructure is severely deficient; even before October 2023 only 60% of households were connected to the sewage network, and around 90 million liters of partially treated sewage were discharged into the Mediterranean Sea each day.

PALESTINE EMERGING supports initiatives to secure sustainable long term water supply for Gaza, sufficient to meet total water demand of approximately 260 MCM/year by 2050.

The Gaza/West Bank Link will connect utility networks in Gaza and the West Bank. Solutions will include a centralized regional-scale desalination plant (delivering 250 MCM/year) to supplement groundwater supply and position Gaza as a net exporter of water. Short-term water treatment efforts will focus on repairing existing plants in Khan Yunis, Deir Al Balah and Gaza City.

Coordinated water management will improve the efficiency of water and waste water networks. All treatment plants will be capable of producing tertiary-quality recycled water (suitable for agriculture). Educational campaigns and local enforcement will help shut down illegal wells and boost the adoption of recycled greywater for irrigation.

Short term: PrioritiZe investment into Gas-foR-Gaza and a larger desalination plant in the south

Quartet (2024a,b)

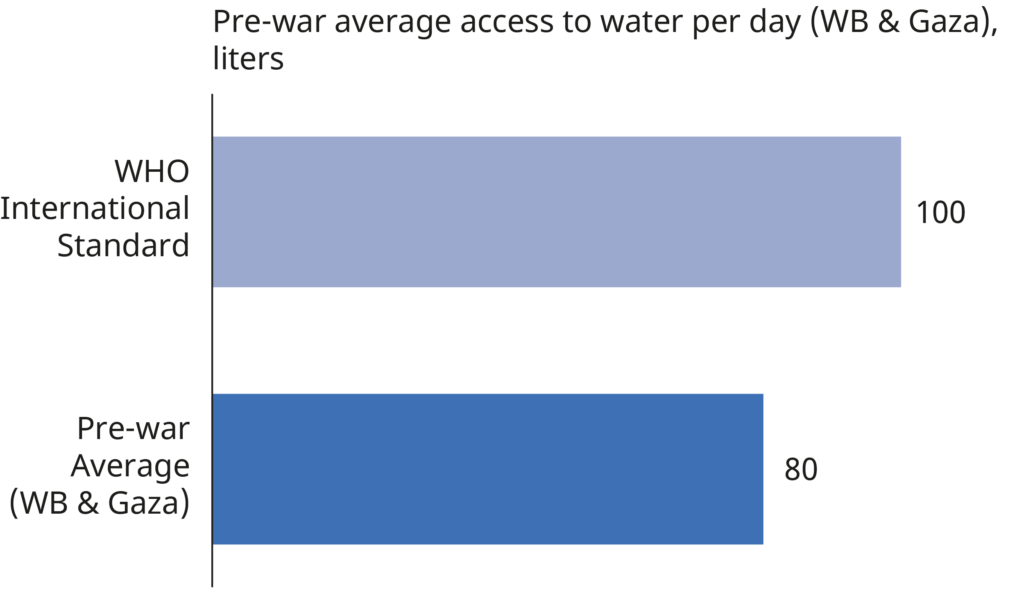

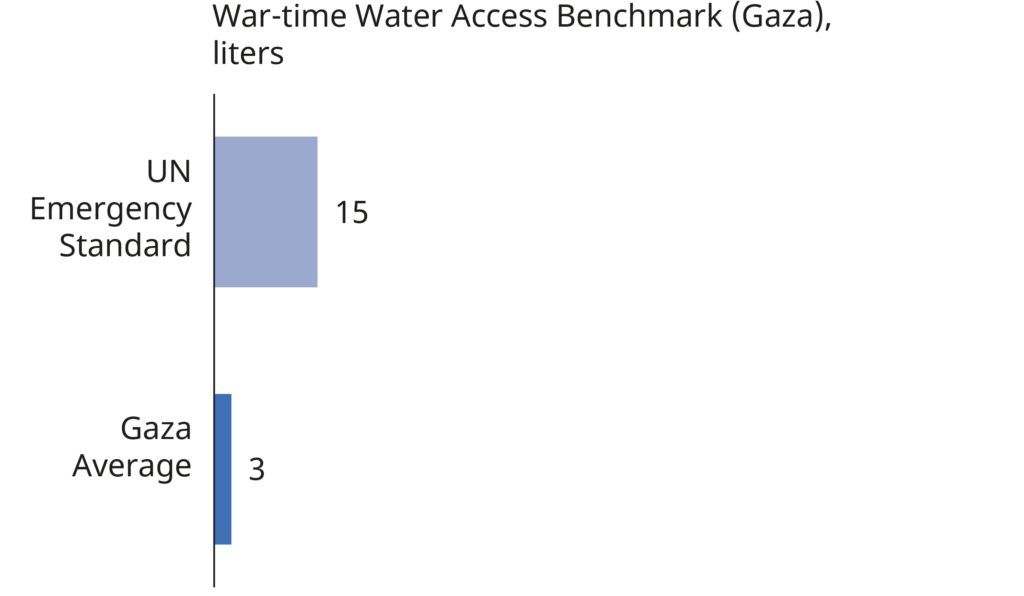

Provision of adequate water supply for consumption is a short-term imperative in Gaza

Figure 17 | ANERA (2023)

Figure 18 | CSIS (2024)

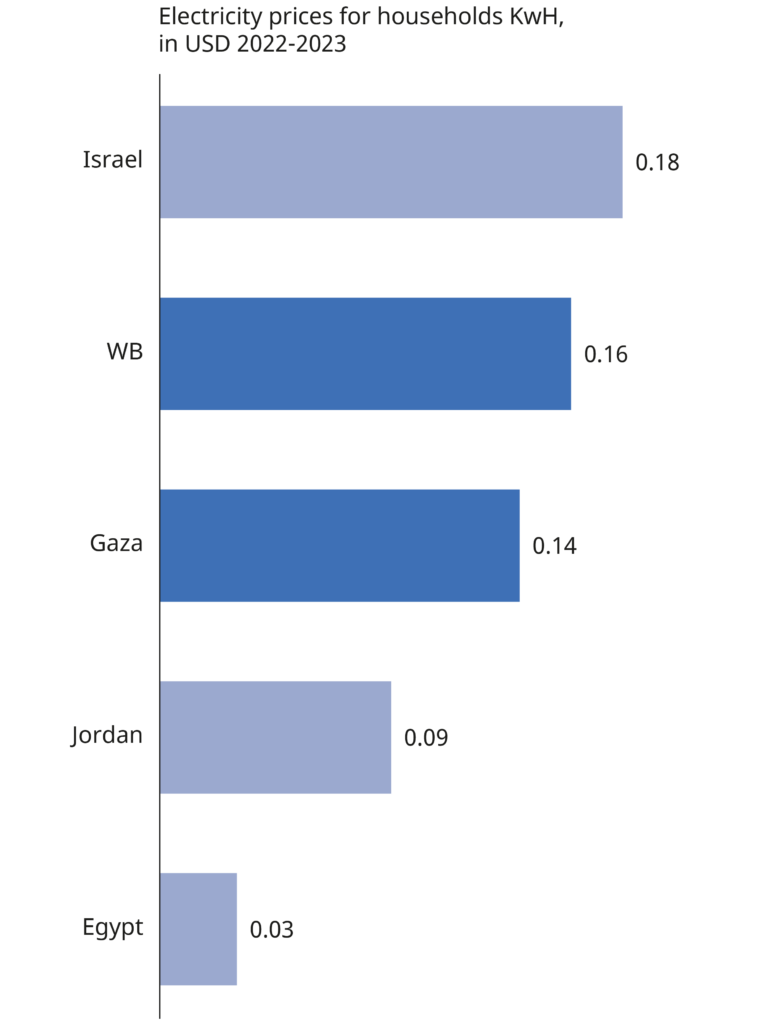

Electricity prices in THE WEST BANK and Gaza are higher than Egypt and Jordan; IN THE LONG RUN, renewable energy should be considered to lower costS and diversify ENERGY sources

Figure 19 | Palestinian Investment Promotion Agency (2022).

Global Petrol Prices (2023).

Gaza Energy Demand and Supply Profile

Figure 20 | Quartet (2024a)

DIGITAL NETWORKS

PALESTINE EMERGING understands that digital networks are fundamental for integrating Gaza and the West Bank into global markets and achieving the necessary sectoral shifts to improve their economies. Digitized industries increasingly rely on internet connectivity, big data, 5G, and artificial intelligence to increase capital and labor productivity and obtain goods and services at lower prices, thus contributing to economic growth.

After decades of relative technological stagnation, strategic digital networks will enable Palestine

to ‘leapfrog’ certain levels of development, similar to the way China bypassed the slow implementation of local landline communications and transitioned directly to mobile technology, or some African metropolitan areas moved beyond traditional energy networks to smart off-grid energy.

Palestine currently does not control its own ICT infrastructure. Palestinians in the West Bank are only able to use 3G mobile services, while those in Gaza only get 2G – these are considerably slower than global standards and are more vulnerable to security attacks due to weaker encryption. Israel is upgrading from 4G to 5G. Palestinian cellular communication companies have lost up to $2B/year in potential revenue due to restrictions on frequencies and equipment alongside unauthorized competition from Israeli operators.

Digital connectivity is lifesaving. During initial periods of reconstruction, trained personnel

and medical equipment will be in critically short supply. Reliable high-speed digital bandwidth

will allow patients to access tele-health systems and link to regional and international doctors, specialists and diagnostic services to help make up deficits in local health resources. In the short term, extensive WiFi for temporary camps and housing will support stabilization efforts and increase earning potential for related populations.

In the medium term, connectivity hubs will leverage available fiber broadband connections, bringing connectivity to critical community infrastructure like hospitals, clinics, and schools – the core of redeveloping communities.

Digital capacities will expand to include 5G towers and mesh networks. Connectivity hubs will be replicated across Gaza and the West Bank, extending broadband coverage to commercial and personal domains.

In the long term, position Palestine as a test bed for emerging 6G-technology – similar to the way Monaco (another relatively small, spatially constrained territory) has been a testing ground for new mobile standards.

6G (sixth-generation wireless) is the successor to 5G cellular technology. 6G networks will be able to use higher frequencies than 5G networks and provide substantially higher capacity and much lower latency. The 6G technology market is expected to facilitate large improvements in the areas of imaging, presence technology and location awareness. Working in conjunction with artificial intelligence (AI), the 6G computational infrastructure will be able to identify the best place for computing to occur; this includes decisions about data storage, processing and sharing.

6G is not yet a functioning technology. While some vendors are investing in the next-generation wireless standard, industry specifications for 6G-enabled network products remain years away.

First lab testing and pilots of 6G are expected to begin in 2028, preparing 6G for commercial release in or near 2030. Steps toward commercial readiness include the shift from 5G to 5G Advanced in 2024-2025.

GAMECHANGER

WATER INDEPENDENCE

Access to water is a foundational need. For the region in general and Gaza in particular, water and power are inextricably related. Gaza will need to produce desalinated water for its own requirements and to reduce pressure on its aquifer. To do so will require energy.

Investment in centralized desalination will help Palestine achieve water and energy independence in the long run. Parallel efforts include the repair and construction of other smaller desalination plants (e.g., in Gaza City and in Rafah) as well as initiatives to increase electricity supply.

In the long term, Gaza can arbitrage the relative values of water and power to achieve comparative advantages. The relatively low renewable energy prices in Jordan (where availability of land is high) will allow Palestine to import energy at a discount. In exchange, Gaza can supply treated water from its expanded desalination plants to Jordan, where water prices are high due to shortages. Water supply will help Jordan preserve its natural systems and accelerate peacemaking efforts in the region.

SHORT TERM

- Invest in the Gas-for-Gaza project (to provide 600MW of electricity for Gaza).

- Repair and expand the Southern Short Term Low Volume Desalination Plant (STLV) to 250 MCM.

- Convert and expand the Gaza Power Plant to accommodate natural gas.

LONG TERM

Once Palestine can more than meet its own needs, it can arbitrage the relative values of water and power to achieve comparative advantages relative to the region, and develop an export-related commodity.

Long term: Gaza exportS desalinated water to Jordan. Jordan sells solar and wind energy TO GAZA.

Ecopeace Middle East (2024).

PALESTINE EXTENSION TO JORDAN-ISRAEL-UAE GREEN INFRASTRUCTURE

In 2022, the Kingdom of Jordan and the United Arab Emirates signed an advanced memorandum of understanding to meet COP28 targets, build water security, and advance regional prosperity through two levels of bilateral partnership.

The first level will launch a 600 MW solar photovoltaic plant and 300 MW of electric storage in Jordan, with the aim of producing clean energy for export.

Prosperity Blue is a sustainable water desalination project that aims to produce and export 200 million cubic meters of potable water to Jordan every year.

GAMECHANGER

5G NETWORK

5G is the fifth-generation technology standard for cellular networks, which cellular phone companies began deploying worldwide in 2019. 5G allows for the convergence of multiple legacy networking functions to achieve cost, power, and complexity reductions. For Gaza in particular, this will be a ‘leapfrog’ upgrade from its legacy 2G systems.

In the short to medium term, Gaza in particular will depend on resources that will be absent from the immediate area. Interim housing and emergency camps will have very high concentrations of people in need of digital connectivity. Healthcare systems will lack trained professionals and diagnostic technology. Education, especially higher-level institutions, will need to function in virtual/remote settings.

Enhanced Mobile Broadband (eMBB) uses 5G as a progression from 4G LTE mobile broadband services, with faster connections, higher throughput, and more capacity. This will benefit areas of higher traffic, including urban areas in general, and special locations such as hospitals and schools.

Ultra-Reliable Low-Latency Communications (URLLC) are the basis for mission-critical applications that require uninterrupted and robust data exchange. This will benefit activities like remote surgical operations.

Massive Machine-Type Communications (mMTC) are particularly useful to support large concentrations of civilian drones and IoT devices, aiding in disaster recovery efforts, and providing real-time data for emergency responders. Autonomous vehicles will also benefit from 5G technology.

APPLICATION FOR GAZA/WEST BANK

Gaza’s relatively flat terrain allows for 5G towers spaced approximately 1.6-5Km apart, a total of 100-150 towers communicating with each other. In addition, tower placements and additional software will support a mesh network that maintains local and regional connectivity if/when international connectivity is interrupted.

5G towers are linked to centralized data transmission hubs, connected by high-capacity fiber which is in turn linked to broader networks (e.g. Egypt and Jordan). Alternatively, high-capacity microwave can transmit over 20-30 km with line-of-sight. This is a more expensive solution but offers connectivity without physical transit across an Israeli border.

Based on Oxford Economics research, 5G has the potential to boost productivity by 1.7%, and increase GDP 10% by 2030

Cabello, K. (2023).